Pocket Option has gained popularity in the trading community, especially among those looking for a user-friendly platform for binary options trading. However, a common concern among potential users is whether Pocket Option is a regulated entity. Compliance with regulatory standards is crucial in the trading world since it impacts the safety and security of trader funds and overall trading experience. If you’re curious about the legitimacy of Pocket Option as a regulated broker, read on to explore the details. is pocket option a regulated broker промокод Pocket Option

Understanding Regulation in Trading Platforms

Before diving into Pocket Option’s regulatory status, it’s essential to understand what regulation means in the context of trading platforms. Financial regulation refers to the government-imposed rules and guidelines that aim to ensure that trading firms operate fairly, transparently, and ethically. Regulatory authorities are set up across various jurisdictions to monitor the activities of financial service providers and protect consumers.

Is Pocket Option Regulated?

As of the latest updates, Pocket Option operates under the jurisdiction of the International Financial Market Relations Regulation Center (IFMRRC). While the IFMRRC provides a level of oversight, it’s important to note that this body does not hold the same stringent regulatory standards as more recognized entities such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the United States.

This means that while Pocket Option is indeed registered with a regulatory entity, the level of protection and consumer safeguards may not be as robust compared to regulated brokers. Thus, traders should be aware of the level of risk they are accepting when trading with such platforms.

The Impact of Regulation on Traders

Choosing a regulated broker is critical for the safety of your trading capital. Regulated platforms are required to adhere to strict standards, including how they handle client funds. For instance, many regulatory bodies require firms to keep clients’ funds in segregated accounts, which means that the money is separated from the broker’s operational funds. This helps protect traders in case the broker experiences financial difficulties.

In comparison, an unregulated broker poses a higher risk. There are no guarantees regarding the handling of your funds, and you may have limited avenues for recourse in case of disputes. Therefore, when considering platforms like Pocket Option, it’s essential to weigh the pros and cons before investing your money.

Trading Features Offered by Pocket Option

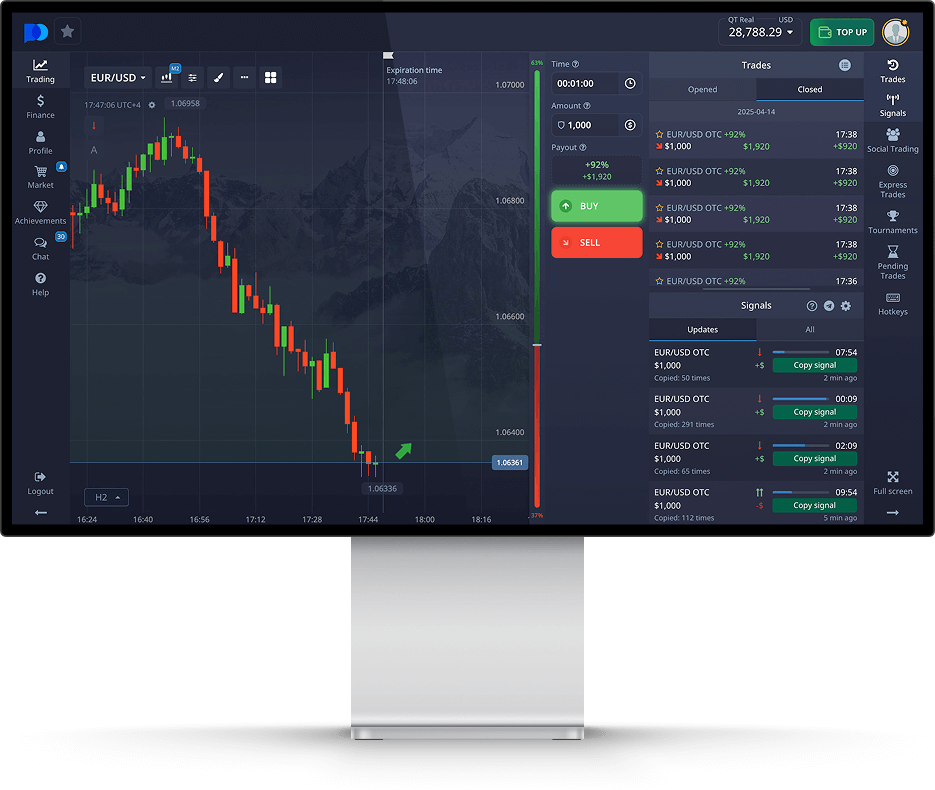

Despite the regulatory concerns, Pocket Option offers a variety of trading features that appeal to many traders. The platform boasts a user-friendly interface, making it accessible for beginners, while also providing advanced tools for seasoned traders. Some of the notable features include:

- Social Trading: Pocket Option allows traders to follow and copy the trades of successful investors, providing an excellent opportunity for beginners to learn from more experienced traders.

- Range of Assets: The platform offers a diverse range of assets, including Forex, commodities, cryptocurrencies, and stock indices, allowing traders to diversify their portfolios.

- High Returns: Traders can earn returns of up to 92% on selected trades, which is attractive for those looking to maximize their profits.

- Demo Account: Pocket Option provides a demo account feature, allowing users to practice trading without the risk of losing real money.

Risk Management and Best Practices

Regardless of the platform’s regulatory status, it is essential for traders to practice effective risk management. Here are some best practices:

- Start Small: If you are a new trader or trying out a new platform, start with a small amount to minimize potential losses.

- Diversify Your Investments: Do not put all your funds into one asset or trade. Diversifying your investments can help manage risk more effectively.

- Stay Informed: Keep up with the latest market news and trends, as they can greatly impact your trading outcomes.

- Set Limits: Establish clear limits on how much you are willing to risk in each trade and stick to them.

Conclusion

In summary, while Pocket Option operates under a regulatory authority, it does not have the same level of oversight as more established regulatory bodies. This means that while traders can utilize the platform’s features, they must remain aware of the risks involved. The decision to trade with Pocket Option or any other broker should be made after careful consideration of all available information and personal risk tolerance. Always ensure that you’re equipped with the necessary knowledge and skills to trade responsibly.

Final Thoughts

As the trading landscape continues to evolve, the importance of regulatory compliance remains a key topic of discussion among traders. By understanding the regulatory status of platforms like Pocket Option, individuals can make informed decisions and navigate their trading endeavors with greater confidence.